For most people, figuring out how to get paid for a job comes down to a few choices: cash, check, or electronic transfer of some sort.

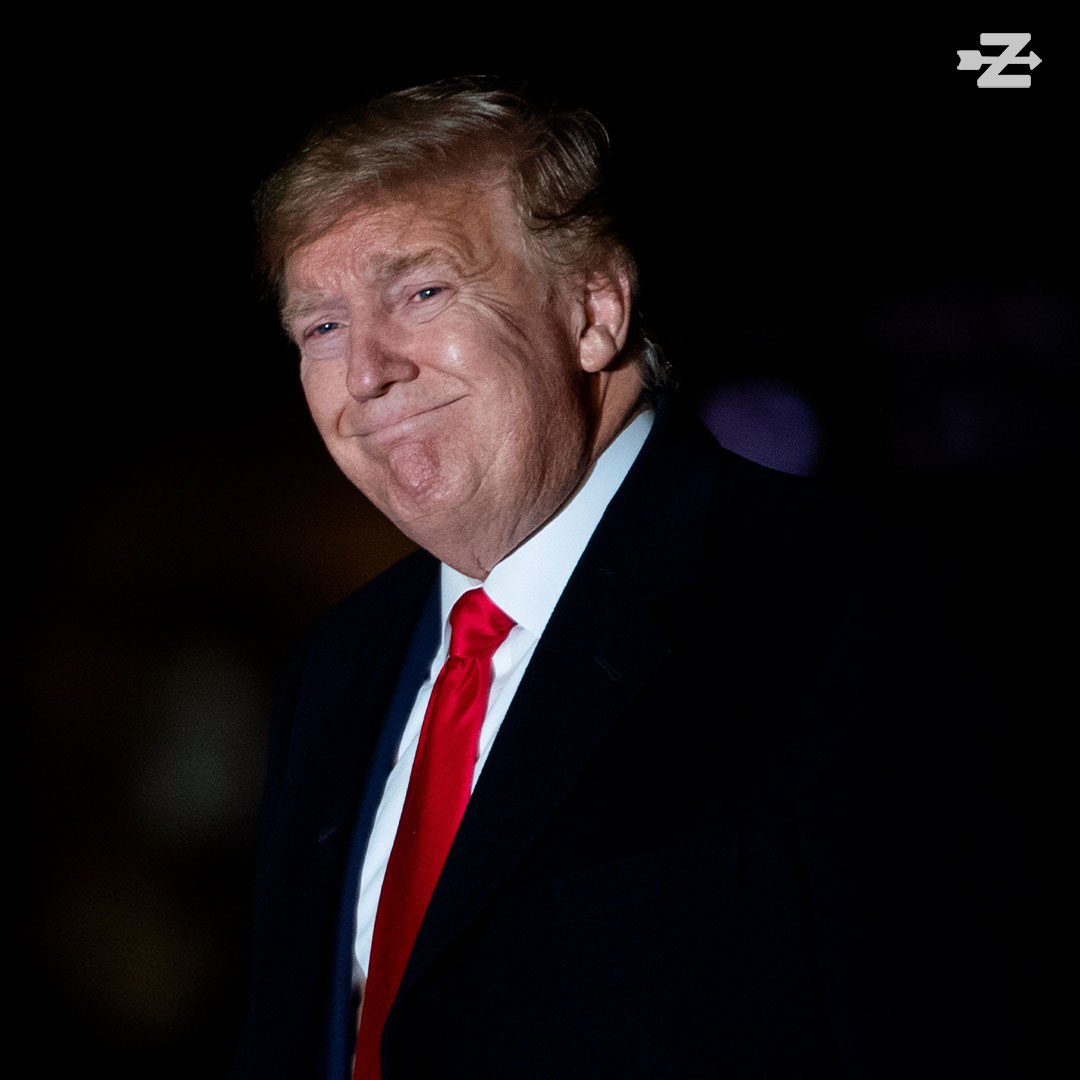

If you’re Donald Trump, though, you also have the option of being paid in gold bars. Because, obviously.

A new book forthcoming from New York Times reporter Maggie Haberman has revealed that among some of Trump’s more questionable practices include being paid for a lease with a box of gold bars because it’s what his tenant had to hand.

When the bars arrived, Trump was reportedly confused about what to do with them. He had Matt Calamari, a former security guard who became COO of the Trump Organization, wheel them up to his private apartment. What became of them after, nobody knows.

Haberman’s book also reveals numerous times when Trump used threats or blackmail to get what he wanted from people, including threatening to out Michael Forbes (late owner of Forbes magazine) as gay to prevent them from publishing a story that his net worth was lower than he claimed.

It’s a poignant revelation against the backdrop of a lawsuit filed by New York Attorney General Letitia James yesterday against Trump and his kids.

The lawsuit alleges that the Trump family falsely inflated their business’s value to get more favorable loan terms and pay lower taxes.

Considering he was willing to blackmail a person with their sexuality and private life to keep his actual net worth under wraps, James’ argument seems all the more plausible.

We are losing America more each day & we have sitting president that is more corrupt than ever but people want to focus on Trump. The fear is real on what this man has on them and the things he could do. But please let’s find more things from his past to make attempt number 5.6.7 I don’t know I lost count to put him away.

It’s a different world now kids.

it does not matter how DJT or anyone else was paid as long as the income is reported to the IRS. IRC 61: General definition

Except as otherwise provided in this subtitle, gross income means all income from whatever source derived, including (but not limited to) the following items:

(1)Compensation for services, including fees, commissions, fringe benefits, and similar items;

(2)Gross income derived from business;

(3)Gains derived from dealings in property;

(4)Interest;

(5)Rents;

(6)Royalties;

(7)Dividends;

(8)Annuities;

(9)Income from life insurance and endowment contracts;

(10)Pensions;

(11)Income from discharge of indebtedness;

(12)Distributive share of partnership gross income;

(13)Income in respect of a decedent; and

(14)Income from an interest in an estate or trust.