It comes as no surprise to most that Millennials are not buying homes at the same rate as their elders. Home rates are falling as people in their late 20s to late 30s scramble to afford the basic necessities with less prosperity than their parents and (in many cases) grandparents.

Millennials are paying off student debts and facing wage stagnation at historical rates, pressed up against the rising cost of housing and day-to-day inflation.

And it’s a ripple effect. With less ability to purchase property and begin building long-term wealth and financial stability, millennials will become entire retirement and old age with less security and more uncertainty.

The homeownership rate fell to 63% in 2016, making it the lowest rate in 50 years and down markedly from the all-time high of around 70% found in 2005. This should be the time when millennials are buying homes, thriving, and enjoying the height of life – but their options are few, and their future looks fraught.

A lack of affordable lifestyle means that fewer millennials are choosing to have children, and down the line, this will eventually lead to a skill shortage – when millennials retire. Their non-existent children should have taken over the workforce but won’t be there to take up the mantle of their elders.

The reasons why things are so stark for millennials are myriad. Still, it comes down to different beliefs about what family and life should look like, different goals for marriage and children, and the grind of low wages in a high-cost economy.

And it doesn’t look like things will get better any time soon.

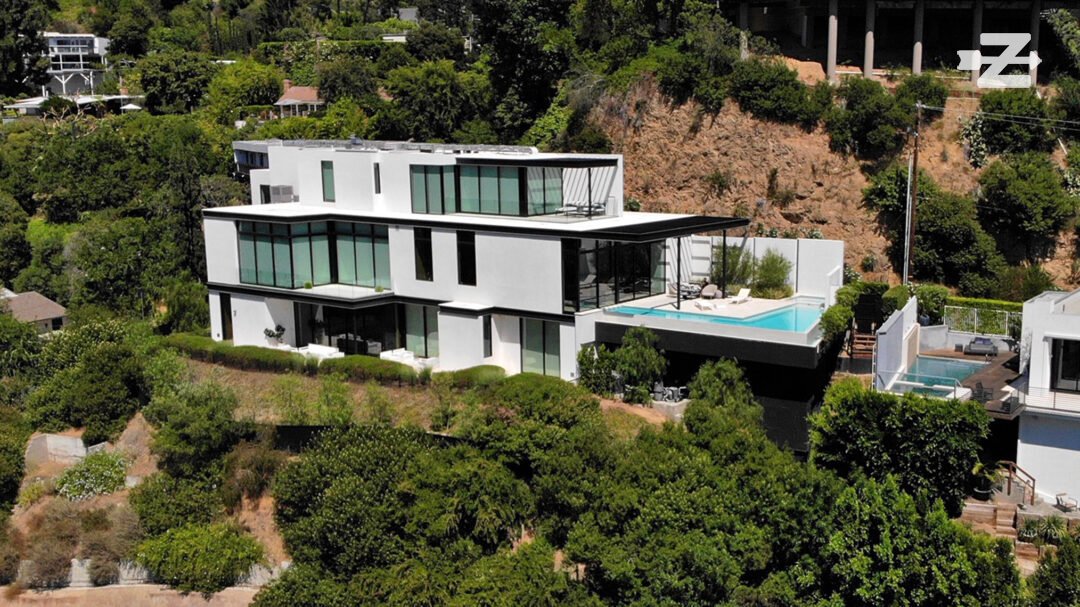

**Images above – the home of Ariana Grande for millennial reference.**