Update:

HSBC UK is purchasing Silicon Valley Bank UK for a symbolic amount – just one dollar.

The UK subsidiary of the now-defunct was purchased in an 11th-hour deal, providing relief to the UK tech sector. The quick approval of the deal is meant to show the government’s support of tech and confidence in the country’s financial system.

Original story:

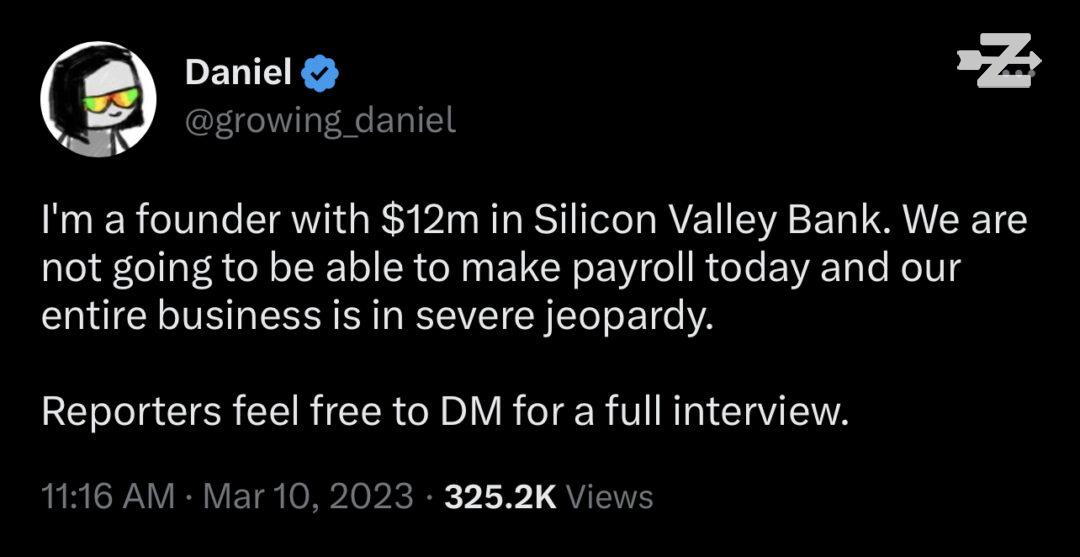

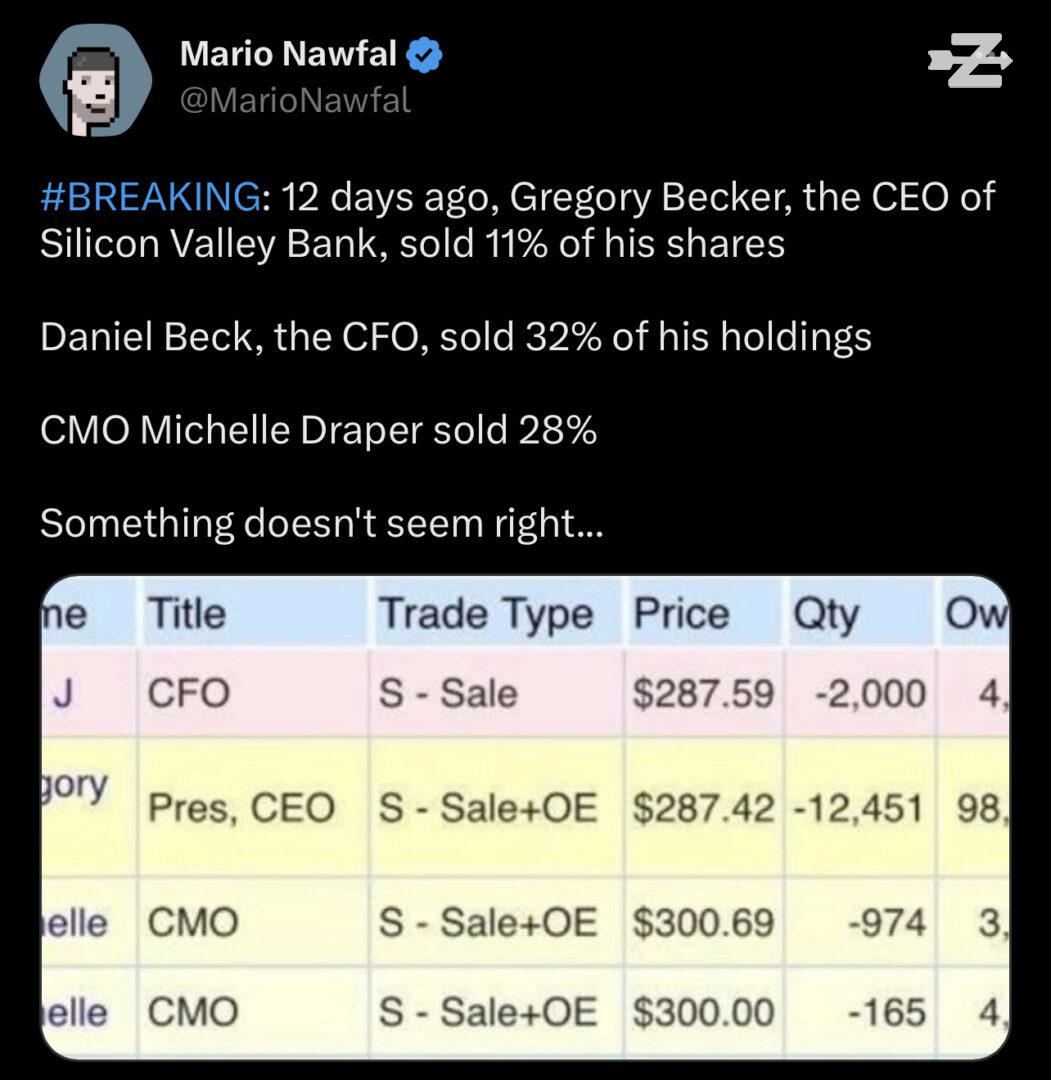

Federal regulators shut down Silicon Valley Bank on Friday.

It was a breathtaking collapse for the tech lender, and it has sparked fears that there’s a wider issue in the banking sector. SVB was a favored banking partner for tech startups and venture capital firms, but the bank’s finances took a bad turn recently as economic downturn and a slowdown in the initial public market led clients to cut back on deposits.

The FDIC released a statement that read in part, “To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB).” They added, “At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank.”

The FDIC said that insured depositors will have “full access to their insured deposits no later than Monday morning” and that official checks will “continue to clear.”

Uninsured depositors will receive a “receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors,” they added.

SVB CEO Greg Becker has urged investors to “stay calm” as the bank works to find a solution for its liquidity crisis.