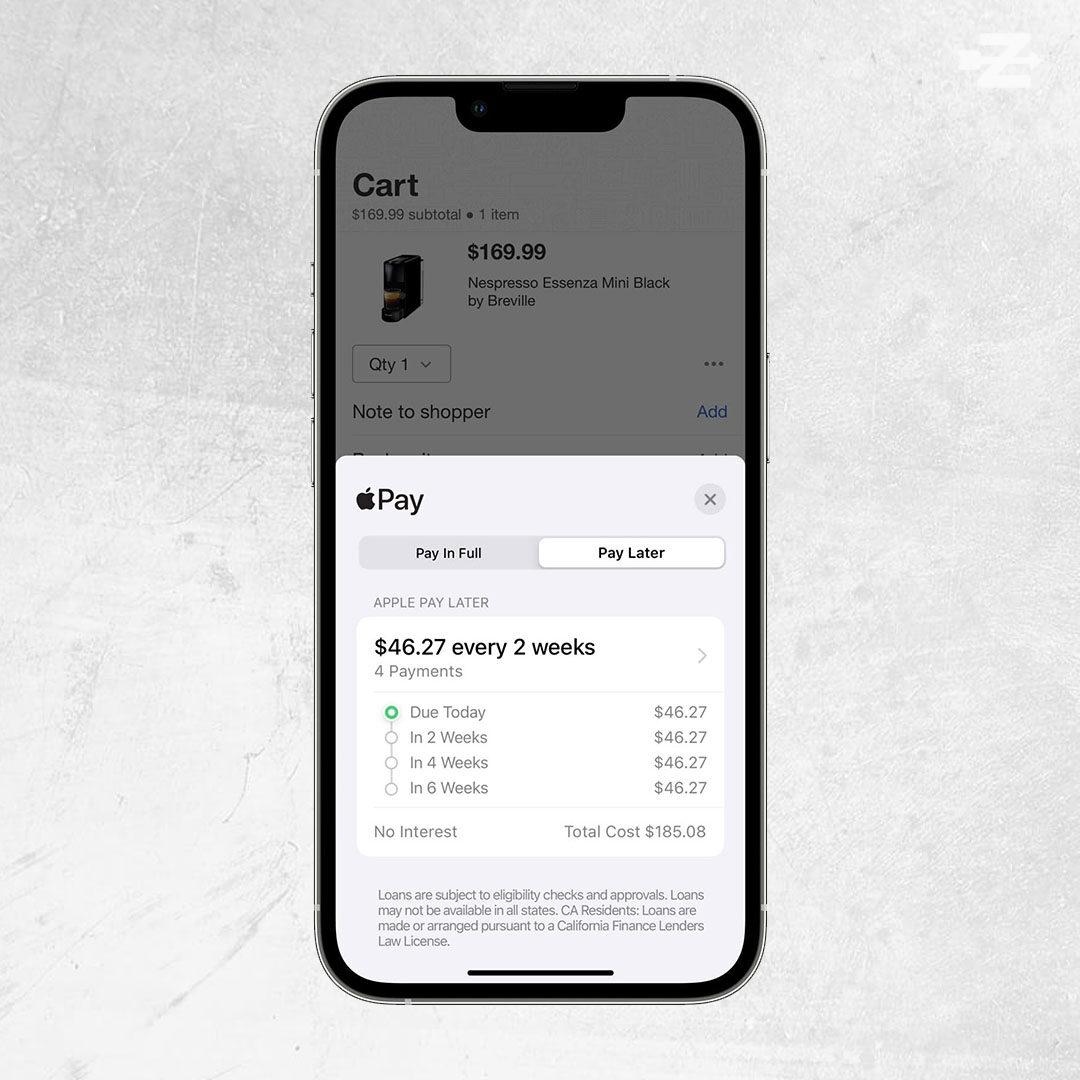

Apple is joining the ranks of companies like AfterPay to offer a “pay-in-4” system to customers.

People who use the program will be able to split purchases into four payments, spread over six weeks, with no interest and no fees.

Apple Wallet will be the home base for these short-term loans, so users can track, manage, and repay their purchases directly through the app.

Loans will be available in amounts of $50 to $1000, and can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.

Starting today, Apple is rolling the feature out to select users to enjoy a prerelease version, with plans to offer it to all customers in the upcoming months.

The same type of pay system already exists with other companies such as PayPal, Klarna, AfterPay and Affirm. All of them have come under some criticism for creating unwinnable debt cycles for people. But used responsibly, they can provide purchasing power to people with poor credit who wouldn’t otherwise be able to afford larger lump sump payments.

It’s unclear what the credit score and history requirements will be for users to receive approval, and turning to other established systems offers a mixed view. AfterPay, for instance, approves people with low credit for low purchase amounts. Affirm has a higher credit score requirement, but also allows higher loan amounts.

Apple Pay Later is available with iOS 16.4 and iPadOS 16.4